RR Kabel, the wires and cables manufacturer has preponed its listing date by four days and decided to list shares on the exchanges on September 20, two days after the issue close.

RR Kabel, a Gujarat-based consumer electrical products company, has set a new record in the Indian stock market by becoming the first company to use the T+2 deadline for listing its shares after the initial public offering (IPO). The company has announced that it will list its shares on the bourses on September 20, just two days after the issue close.

This is less than the timeline finalized by the market regulator Sebi in June this year, which reduced the listing timeline after an IPO to three days after the closure of the issue from the present T+6. “The revised timeline of T+3 days shall be made applicable in two phases i.e. voluntary for all public issues opening on or after September 01, 2023 and mandatory on or after December 01, 2023,” Sebi said in June.

The T+2 deadline means that the entire process between the issue closing date and the listing date has been settled in one single day. Earlier, after the issue closure, the company finalized the basis of allotment of IPO shares by the third day (post-issue closing), refunded money to unsuccessful investors by the fourth day and credited shares to demat accounts of successful investors by the fifth day, followed by listing on the sixth day.

The global private equity firm TPG-backed company had earlier proposed to list on September 26, i.e. six days after the issue closing, as per the normal IPO schedule. However, the company has decided to prepone its listing date by four days and surprise its investors.

RR Kabel IPO subscription status

The public issue of RR Kabel closed on September 15, with 18.69 times subscription. The company received bids for 17.29 crore equity shares against an offer size of 92.50 lakh equity shares, as per data available on exchanges.

The qualified institutional buyers (QIBs) provided major support to the issue, buying 52.26 times their allotted quota. The high networth individuals (HNIs) and retail investors bid 13.23 times and 2.13 times the portion set aside for them, respectively.

The price band for the offer was Rs 983-1,035 per share. The final issue price has been fixed at Rs 1,035 per share, which is at the upper end of the price band.

RR Kabel IPO GMP

Current Grey Market Premium(GMP) for RR Kabel is around 10-11 percent. The GMP is subject to change according to the market sentiments and other factors.

How will RR Kabel use the money raised from IPO

The wires and cables manufacturer has raised Rs 1,964.01 crore via the IPO, which comprised a fresh issue component of Rs 180 crore worth of shares and an offer for sale (OFS) of Rs 1,784.01 crore worth of shares by six shareholders, including promoter Mahendrakumar Rameshwarlal Kabra and investor TPG Asia VII SF Pte Ltd.

The company intends to use the net proceeds from the fresh issue for repayment or prepayment of certain borrowings availed by it and for general corporate purposes.

About the company

Business background

The company has a diversified product portfolio, a strong distribution network, and a high degree of backward integration.

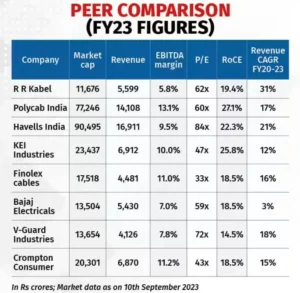

RR Kabel is one of the leading manufacturers of wires and cables (W&C) in India with an estimated market share of 7 percent by value. The company offers a wide range of products, including house wires, industrial wires, power cables, and special cables. The company also has a small presence(~10 percent of revenues) in the fast-moving electrical goods (FMEG) sector, which comprises fans, lighting, switchgear, switches, appliances etc. The company sells its products under the RR Kabel, RR Signature, and Luminous brands.

Long operating history

The company has a long operating history and has delivered a revenue compound annual growth rate (CAGR) of more than 23 percent over the past five years. The company has five manufacturing facilities spread across Gujarat, Uttarakhand, Daman and Diu, Himachal Pradesh, and Karnataka. The company has a high degree of backward integration into copper rods manufacturing, which helps it in reducing raw material costs and ensuring quality control.

Established retail presence

The company has a robust distribution network across India, comprising 3,450 distributors and catering to more than 110,000 retail outlets. The company derives 74 percent of its revenues from the retail focused business-to-consumer (B2C) segment, which is the highest among its listed peers. The company also exports its products to over 80 countries and is among the leading W&C exporters from India.

Future growth and Challenges

The W&C market in India is growing at 10-12 percent per annum due to the government’s focus on infrastructure, rural electrification, urbanization, development of smart cities, and digital transformation. The branded players are gaining market share from the unbranded players due to high technical and regulatory compliances. RR Kabel is well positioned to benefit from this trend due to its strong brand recall and diversified product portfolio.

However, the company also faces some challenges such as raw material and currency fluctuations, which could affect its profitability over the short to medium term. Moreover, the FMEG business is likely to remain a drag on its profitability as it requires higher investment and faces intense competition.